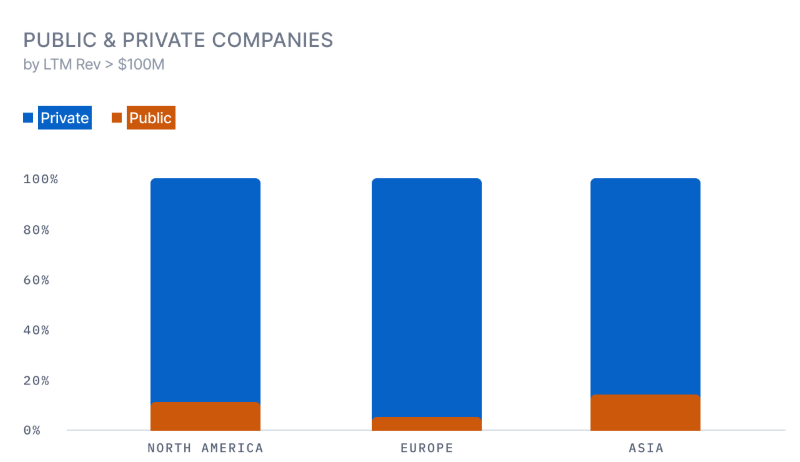

The world of private equity and alternative investments has long been reserved for the wealthy, but ADDX is changing that narrative. Founded in 2017 by Danny Toe and Inmoo Hwang, ADDX is an investment platform that provides accredited investors with access to a diverse range of alternative investments such as private equity, hedge funds, and private debt. By leveraging digital tokenization, ADDX is creating a more inclusive and accessible investment ecosystem.

Making Private Markets Available

ADDX aims to make alternative investments more accessible by lowering the entry barrier. The platform’s use of tokenization allows accredited investors to participate in private markets with as little as $5,000.

Through its regulation by the Monetary Authority of Singapore, ADDX ensures a safe, transparent environment for investors to explore opportunities in private equity, hedge funds, and more. With a valuation of $290M and $136M in funding, ADDX is on a growth trajectory to expand its offerings and reach a broader audience.

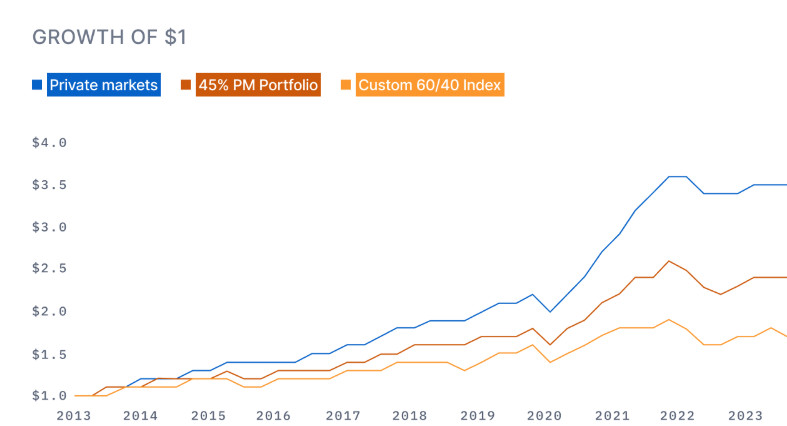

A New Era of Investment

As ADDX continues to expand, its focus will remain on providing alternative investments to individuals seeking opportunities beyond traditional stocks and bonds. With its cutting-edge technology, ADDX is making private equity more accessible and liquid.

The platform is poised to revolutionize the way accredited investors approach private markets, providing them with greater flexibility, transparency, and opportunities to diversify their portfolios.

To read more startup stories visit- singaporebusinessedge